Horizon 2020: Supporting transformation in the agri-food sector

“There were multiple challenges, including a substantial amount of EU politics at the start with many partners wanting to take the lead, but we were determined to keep DEMETER rooted in Ireland.”

Kevin Doolin, Co-ordinator of the DEMETER project and Director of Innovation at Telecommunications Software & Systems Group

Overview:

- TSSG, part of the Waterford Institute of Technology, is leading a project that aims to transform Europe’s agri-food sector through the rapid adoption of advanced Internet of Things technologies, data science and smart farming.

- The DEMETER project is being significantly funded by the European Union’s Horizon 2020 research and innovation programme.

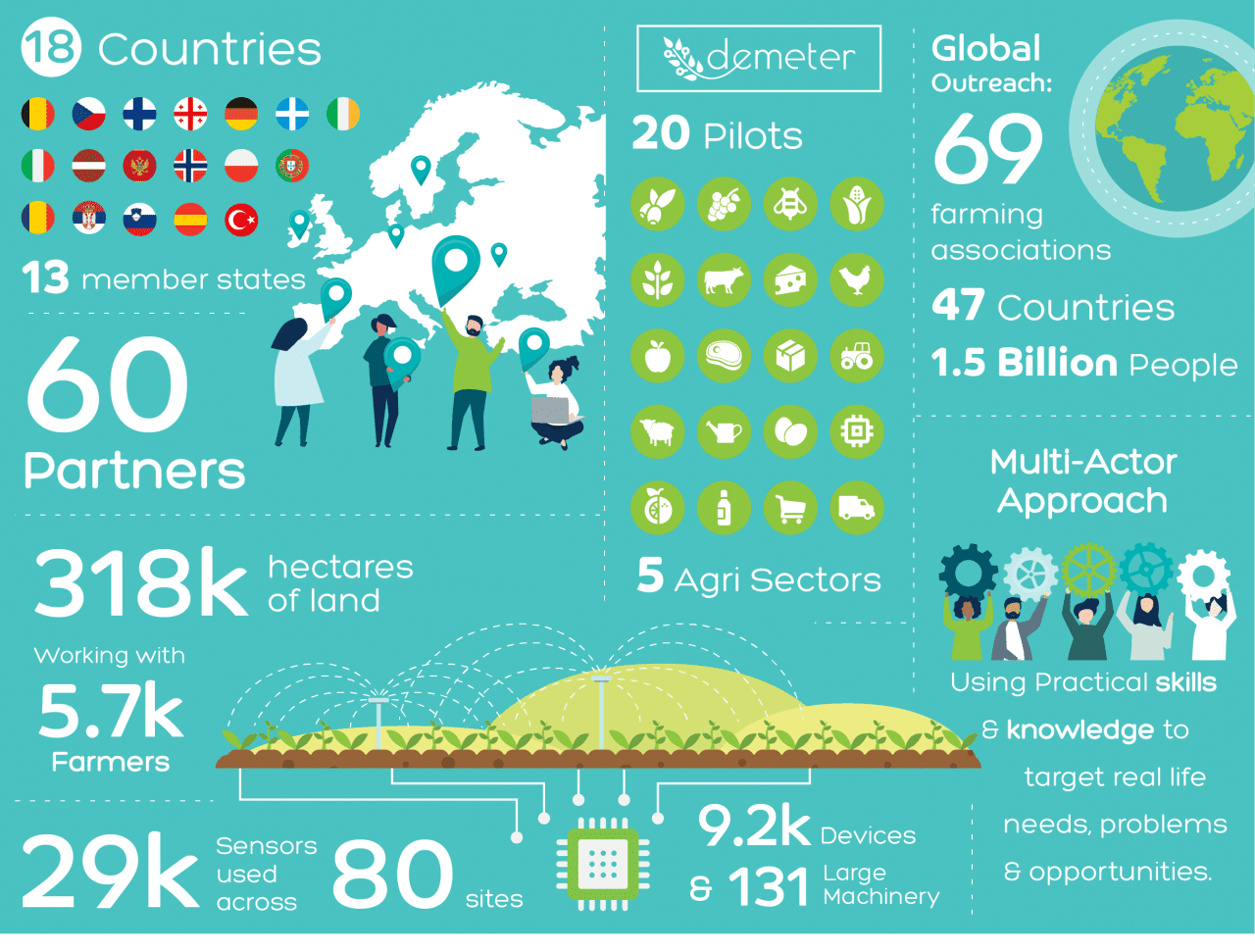

- With 60 partners, 18 countries and 20 pilots, DEMETER is one of the largest Horizon 2020 projects coordinated by an Irish entity and is expected to have significant impact across the agri-tech sector in Europe, and beyond.

Overview:

- TSSG, part of the Waterford Institute of Technology, is leading a project that aims to transform Europe’s agri-food sector through the rapid adoption of advanced Internet of Things technologies, data science and smart farming.

- The DEMETER project is being significantly funded by the European Union’s Horizon 2020 research and innovation programme.

- With 60 partners, 18 countries and 20 pilots, DEMETER is one of the largest Horizon 2020 projects coordinated by an Irish entity and is expected to have significant impact across the agri-tech sector in Europe, and beyond.

The European Union has identified smart farming as a key component in supporting sustainable agriculture and food production, protecting natural resources and boosting food safety. At the heart of this is the need for new technology and standards to achieve full supply chain interoperability.

This is the subject of DEMETER, a large-scale, €17.7m Horizon 2020 project involving 60 partners across 18 countries, 6,000 farmers and 38,000 devices.

At the helm of DEMETER is Kevin Doolin, Director of Innovation at Telecommunications Software & Systems Group (TSSG), an internationally recognised centre of excellence for ICT research and innovation and part of the Waterford Institute of Technology.

“The situation now is that you have various different elements in the agri supply chain – machinery, warehouses, trucks, sensors and so on – but none of these systems talk to each other so it’s impossible to get a holistic view from farm to fork,” explains Doolin.

“With DEMETER we’re trying to connect those elements, so we’re developing new industry standards, writing software for platforms and building interfaces.”

DEMETER’s goal is nothing less than the digital transformation of Europe’s agri-food sector and it includes a series of 20 pilot programmes that aim to demonstrate the impact of the technology.

A key deliverable is the DEMETER Dashboard. “This will give farmers an instant update on the status of their farm. It’s a precision support system that provides information to assist decision making, and increase productivity and efficiency,” says Doolin.

The Horizon 2020 process

The first step in the Horizon 2020 process is building the consortium, which Doolin did using his extensive network of contacts and the opportunities afforded by networking events run by the Commission.

“It’s important to identify a core set of partners that you can rely on to help write the proposal. Within DEMETER there are about 10 partners that did most of the heavy lifting on that, and then we drew on expertise from the other partners when required.

“We also engaged quite heavily with Enterprise Ireland’s National Contact Points who were able to introduce us to additional partners. And the EI financial support we got to write the proposal was really important.”

As a highly experienced Horizon 2020 co-ordinator, Doolin was aware of the challenges a project of this size, one of the largest ever coordinated by an Irish entity, presents.

“There were multiple challenges, including a substantial amount of EU politics at the start with many partners wanting to take the lead, but we were determined to keep DEMETER rooted in Ireland,” says Doolin.

Co-ordinating 60 partners is an ongoing challenge but one that is mitigated, says Doolin, by having good work package leaders.

“Each Horizon 2020 project is structured into a number of work packages with specific roles. If you have a good team of work package leaders you can leverage them very heavily to co-ordinate the overall effort.”

Moreover, the challenges are offset by the benefits.

“Horizon 2020 enables us to engage in large-scale work, with a substantial group of partners from across the agri supply chain. We have access to technology providers, research and academic experts, real works users and policy makers,” says Doolin.

Walk before you run

Involvement in a Horizon 2020 project can be as a partner organisation or as co-ordinator. Doolin strongly recommends starting as a partner.

“I estimate the level of work involved in being a participant versus co-ordinating to be about 1:10, so I think the best place for institutions to start is by partnering on a proposal and maybe taking a work package leader role where you’re involved in writing the proposal. After you’ve done a few projects you can go down the route of co-ordination, starting with a small project.”

Doolin also advises engaging early with Enterprise Ireland to find out the project topics that are coming up in the next Horizon round of funding, and starting to build the consortium before the Commission launches the call for proposals.

“After the call you’ve only three months to write the proposal, which isn’t a lot of time,” he says.

“It’s also important to tell Enterprise Ireland what proposals you’re writing or you can end up in a situation where different entities in Ireland are writing competing proposals when in fact we should be collaborating. Enterprise Ireland is the mechanism for bridging that gap.”

Within the DEMETER project €1m of funding has been reserved to be given out to new partners who want to join the programme.

“We’ll be issuing our own mini-calls for proposals starting on September 16, inviting SMEs and farmers and so on to come up with a small project idea that will test elements of DEMETER in different scenarios.

“These open call projects are something that I think industry in Ireland needs to take advantage of. It’s a really good way for companies to get into Horizon 2020 and get quite a bit of funding to do just one trial of the technology.”

For advice or further information about applying for Horizon 2020 support please contact HorizonSupport@enterprise-ireland.com or consult www.horizoneurope.ie

With the help of

With the help of