Portwest – targeting new markets with GradStart

“Bringing linguistic graduates onboard allowed us to bring in talent that could research Spanish and French speaking territories, and open opportunities for our sales teams, which contributed to our target of 20% growth.”

Deirdre Clarke, HR Manager, Portwest

Overview:

- Portwest is a market leader in the design and manufacture of stylish, comfortable, high-quality workwear that meets recognised international standards.

- With customer support staff in over 120 countries, the company used Enterprise Ireland’s GradStart initiative to attract fresh graduate talent with French and Spanish language skills to research new markets and drive business activity.

- The GradStart programme offers salary support of up to 70% for the employment of graduate talent to assist companies when expanding into new markets.

Overview:

- Portwest is a market leader in the design and manufacture of stylish, comfortable, high-quality workwear that meets recognised international standards.

- With customer support staff in over 120 countries, the company used Enterprise Ireland’s GradStart initiative to attract fresh graduate talent with French and Spanish language skills to research new markets and drive business activity.

- The GradStart programme offers salary support of up to 70% for the employment of graduate talent to assist companies when expanding into new markets.

1. What attracted you to get involved in GradStart?

We are very fortunate to have a great Development Advisor (DA), who consistently keeps us informed of programs which may be of benefit to our specific business. As we had already taken part in the similar G4IG program, we felt that GradStart would be another fantastic initiative from Enterprise Ireland to help with the development and international growth of our business. At that time we were also in the process of developing a formal Portwest Graduate Program. The timing was ideal for us as GradStart gave us the additional option of introducing a linguistic element to this program.

2. What did GradStart allow you to do that you wouldn’t have done otherwise?

GradStart allowed us to provide opportunities to newly qualified graduates at our headquarters here in the West of Ireland, and to include a linguistic dimension to our commercial team which up to now was 100% English speaking. We now have two talented graduates with French and Spanish capabilities who are able to help us explore new market opportunities In particularly across South America and Mexico.

3. What challenges and/or opportunities did GradStart help you address?

We had struggled with the exploration of non-English speaking markets. Bringing linguistic graduates onboard allowed us to bring in talent that could research Spanish and French speaking territories, and open opportunities for our sales teams, which contributed to our target of 20% growth. In turn, this allowed us to provide further job opportunities in these regions as we were able to justify the recruitment of sales staff to follow through on the opportunities identified by our graduates.

4. Which areas of the business did the graduate contribute to?

Market research and explorative work in heretofore unexplored territories. This is ongoing and while GradStart partially funds the salaries for such graduates for a two year period, we would envisage the continuation of such due to the success of these roles and how the program helps contribute to Portwest’s growth.

5. Were there any learnings from your participation in GradStart that you have taken forward into your business.

We have learned that only hiring experienced staff with x years’ experience in x industry can be limiting. Hiring graduates with their fresh approach and up to date knowledge of their areas of expertise can truly contribute in a meaningful way to our corporate goals. Furthermore, the satisfaction of being able to bring these graduates straight from college to management roles within such a short space of time is highly rewarding for any employer. We currently have graduates in managerial positions in our sites in Australia, USA and HQ and will look to add Europe and the UK to this as part of our 2020 Graduate program.

6. Would you recommend GradStart to your business peers? If so, why?

This is a fantastic way to introduce a graduate program to your company if you do not already have one. We had previously brought in graduates on an ad hoc basis, but between G4IG and now GradStart, this meant that we were able to formalise a program and become confident in our offering. This is a fantastic opportunity for any graduate looking to kick-start their career and with Enterprise Ireland funding, it is wonderful that businesses can get involved in such a great initiative.

7. Which languages were the graduates skilled in?

French and Spanish.

8. Have you stayed in touch with the graduate?

Yes – our graduates are still with us as they joined us in September 2019 for a two year period. One graduate will remain on site here at Portwest HQ while the other, following an initial training period at Portwest headquarters, has now relocated to our Kentucky office where they will continue to work with our Sales, Commercial and Marketing teams on exploring new markets. We see this as an ongoing project now, and a model which we would hope to continue after our current GradStart program is complete.

Learn more about GradStart and how it can support your business growth.

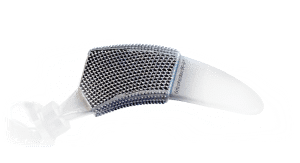

“The idea for the device came about when we were approached by industry people who were looking for a solution relating to treating heart failure in a specific way. We had developed a solution related to aneurysms so we decided to take that and evolve it so that it could be repurposed and applied to another heart failure indication.

“The idea for the device came about when we were approached by industry people who were looking for a solution relating to treating heart failure in a specific way. We had developed a solution related to aneurysms so we decided to take that and evolve it so that it could be repurposed and applied to another heart failure indication.

This clinical perspective has been essential for advancing the prototype development and potential clinical value of the technology.

This clinical perspective has been essential for advancing the prototype development and potential clinical value of the technology.

With strong indications that there was a market for the sensors, particularly in the meat industry, the next step was to do a proof of concept study. In 2013, Evans secured

With strong indications that there was a market for the sensors, particularly in the meat industry, the next step was to do a proof of concept study. In 2013, Evans secured  Evans admits that the pathway to commercialisation wasn’t straightforward.

Evans admits that the pathway to commercialisation wasn’t straightforward. Having taken the early stage research to successful industrial scale production, Comby is well placed to direct the future development of the technology. And he feels he has acquired new skills along the way.

Having taken the early stage research to successful industrial scale production, Comby is well placed to direct the future development of the technology. And he feels he has acquired new skills along the way.