Market Watch Industry Bulletin – Transport

Download the bulletin here.

Download the bulletin here.

Download the bulletin here.

There are steps that can be taken to mitigate those effects, according to Shirlee Kelly, a strategic sourcing consultant with IDDEA, a strategic procurement consulting company.

“In Ireland, many companies rely on just-in-time delivery for the supply of goods and services, and the success of this strategy is dependent on highly integrated and efficient supply chains,” Kelly points out. “The availability of labour may impact on supply chains, while government actions may lead to delays in physically moving materials from location to location as well as at ports and across borders.”

As a first step, she advises businesses to assess their supply chain risks and identify those critical suppliers that can have a detrimental impact on the business. “Businesses should conduct a health check on their critical supply chains,” she says.

Start by looking at internal data.

The next step is contingency planning. “These plans may include, finding alternatives to normal supply routes, investing time in discovering and conditioning new suppliers,” Kelly advises. “Companies may need to change their sourcing strategies to include a more local approach. If companies are dependent on one supplier, they need to put measures in place to make sure they have sufficient stock and ensure business continuance. It is important for businesses of all sizes to build resilience across their supply channels and keep their key customers informed of the work they are doing to meet demand.”

Good supplier management is essential in order to reduce the potential impacts of supply chain disruption. “You may have 500 suppliers, so it is not possible to manage every supplier in the same way,” Kelly notes. “We use the Kraljic Matrix to categorise suppliers by the value you spend with them and the risk they pose to your ongoing operations.”

This matrix reveals those suppliers who are strategically important by evaluating them against their value to the bottom line and the risks of a disruption affecting their performance. High-value, high-risk suppliers clearly need careful management, as indeed do those in the low-value, high-risk quadrant who are defined as bottlenecks.

Supplier management begins with information.

The data analysed, and the knowledge gained, forms the basis of your supplier performance management. “Ensure you have a scorecard in place to allow you measure supplier performance? What metrics do you use and are they aligned with what you are trying to achieve in your overall business strategy?”

“It is important that strategic suppliers work with you on risk management strategies,” she adds.

Those risk management plans should be based on four key elements – awareness, impact, mitigation, and contingency planning.

“Awareness is about understanding the probability and potential impact of the risk,” Kelly explains. “The goal of risk management is to recognise, reduce or mitigate the likelihood of risk. The objective is to identify procedures for managing all stages of risk, this includes, disruption – interruption, response, recovery and restoration of service.

She concludes by pointing out that doing nothing is not an option. “Companies need to act now, investigate the opportunities in your data, identify your key supply partners and work together on problem resolution. Treat key suppliers as an extension of the business and find out how you can support each other. Irish businesses are very good at working together in difficult times. Government bodies such as Enterprise Ireland are a great resource for information on the various supports available to Irish businesses. The companies I am currently working with are sharing information with their supply base and this is helping to ease supply chain problems.”

Download the bulletin here.

Download the bulletin here.

If you are considering doing business in China, please be sure to explore our tips to enter the market below and also be sure to reach out to our dedicated team.

If you are considering doing business in China be sure to reach out to our team and read our Going Global Guide for more information.

As part of its Brexit response, Enterprise Ireland has focused efforts on supporting Irish companies to identify new market diversification opportunities, including the Gulf region, which has become an important market for Ireland. Entering a new export market is an important strategic decision for any company but with the right preparation the rewards can be mutually beneficial.

As part of its Brexit response, Enterprise Ireland has focused efforts on supporting Irish companies to identify new market diversification opportunities, including the Gulf region, which has become an important market for Ireland. Entering a new export market is an important strategic decision for any company but with the right preparation the rewards can be mutually beneficial.

The Middle East’s largest healthcare exhibition, Arab Health 2020, took place in Dubai in January, demonstrating that the healthcare sector provides a strong example of how Irish pharmaceutical and medtech companies can enter the market or expand further to meet rapidly rising demand in the UAE and wider Gulf region for world-class innovative products, services and expertise across the full spectrum of the healthcare sector.

In the UAE alone, this strong demand is clear with market analysis estimating that spending on healthcare will reach $3.6 billion by 2030. Irish healthcare companies are ready to forge new partnerships with healthcare providers in the UAE to provide patients with the latest world-leading innovations that further enhance the patient experience, improve patient outcomes, and supply lifesaving technologies that are used in healthcare systems worldwide.

Ireland and the UAE already have strong economic ties and mutually beneficial partnerships, including across the healthcare sector. Take, for example, the partnership in Dubai that Martin Dunne, the Director of Ireland’s National Ambulance Service has focused on. Martin has been actively supporting the Dubai Ambulance Service in the provision of training for paramedics, equipping them with world-class life-saving professional training and development. Ireland’s National Ambulance Service, in partnership with the Higher Colleges of Technology in Dubai, provides the curriculum and accreditation for diplomas in emergency medical services that train paramedics and advanced paramedics with life-saving skillsets that benefit Dubai and the UAE.

The partnership is a good example of health diplomacy in action, through country-to-country institutional collaboration that mutually benefits all parties, both public and private sector and country-to-country bilateral relations, and ultimately leads to lives being saved in Dubai.

However, the collaboration goes further than education and training. The Dubai Ambulance Service is equipped with cutting-edge Irish hardware and software related to patient and paramedic safety, operational efficiency, and fleet maintenance and diagnostics. Irish company Acetech, a global manufacturer of vehicle intelligence solutions for emergency service fleets, provide this hardware and software.

At Arab Health 2020, we saw further collaboration between the 14 Irish companies hosted on the Ireland pavilion in the medtech, digital health and pharmaceutical sectors and healthcare providers from across the region – resulting in 10 major contract signings. The companies showcasing their world-leading expertise included:

From its life sciences sector, with a vibrant pharmaceutical industry that exports almost €70 billion annually, through to the innovation of the medtech sector, with exports of €12.6 billion to over 100 countries worldwide, the Irish healthcare industry is a big success story. In the UAE alone, 40% of all Irish goods exports last year were pharma, wellness and medicines-related. Ireland is a global leader in the medtech industry and will seek to leverage its innovative expertise to meet the demand in the region in a sector estimated to be worth $31.6 billion by 2025.

The UAE and Ireland recognise the significant mutual benefits that arise from collaboration and partnership. Arab Health 2020 added a new chapter to this, helping to shape the healthcare services of both countries to benefit their people.

If you are interested in entering a new market or diversifying into a new sector, Enterprise Ireland’s Market Research Centre can help. Read how you can best use this Enterprise Ireland support.

Conducting market research can help to reduce business risks and assist your company to map out its journey to growing exports. To support client companies, Enterprise Ireland has invested in access to premium business intelligence databases in Market Research Centres in Dublin and eight regional hubs.

But how can you best access the Market Research Centre? Follow these five steps to make the most of your time there.

First, consider what the information you need will be used for and in what type of resource it is likely to be found. Resources provided by the Market Research Centre include:

All of this information and research is provided by respected publishers and can only be accessed by clients within the Market Research Centre. The Centre’s information specialists work with a range of providers to ensure your company has access to the most up-to-date knowledge available. Once your research objectives are clear, then you are ready to take the next step.

Get a sense of the databases you would most like to access at the Market Research Centre online before you make an appointment. You can even search for specific report titles here. By preparing in advance, and checking in with the Market Research Centre before your visit, you can ensure that relevant material is available when you need it and that your time is spent efficiently.

Contact the Market Research Centre to discuss your research request and to arrange a visit to the main centre in Dublin or to any of the eight regional office hubs. Currently there are facilities in the following Enterprise Ireland regional offices: Athlone, Cork, Dundalk, Galway, Shannon, Sligo, Tralee and Waterford.

To book your appointment, contact:

Phone: (01) 727 2324

Email: market.research@enterprise-ireland.com

Opening Hours: Monday-Friday, 9am-5pm.

The Market Research Centre blog is the best place to find the latest information about resources. This includes the most recent reports available to Enterprise Ireland clients, arranged into categories that are easy to search. From country-specific reports to individual sector research and Brexit-focused news, visiting the blog regularly will give you a sense of the breadth and depth of research and information available to consult during your visit.

You can also follow the Market Research Centre on Twitter to stay up-to-date with its latest news.

One big advantage of using the Market Research Centre is that you’re no longer alone. The Centre’s knowledgeable information specialists are readily available to guide you towards the most relevant reports and databases for your needs. The Market Research Centre’s information specialists can also help you to determine which reports are most relevant to your needs, or assist you with developing a plan of action on which sector or country you should start researching.

Conducting the right market research is vital for businesses to maintain their competitive edge and enjoy successful export growth. With Brexit a reminder of the importance of diversifying and discovering exciting new export opportunities, get the right support from Enterprise Ireland’s Market Research Centre.

Under pressure over emissions and sustainability, manufacturers are focused on transitioning from the internal combustion engine to a future of connected, autonomous, shared and electric vehicles,(CASE). Traditional supply chains are changing dramatically, as new technology providers force manufacturers to rethink where value can be created and by whom.

To assess the level of opportunity this offers Irish business, Enterprise Ireland asked a panel of experts what lies on the road head.

Barry Napier, CEO of Irish company Cubic Telecom – who provides global mobile connectivity solutions for automotive manufacturers including Audi, Skoda and VW – believes the future will be driven by software rather than hardware.

“The mindset has changed,” he says. “Historically when you went to an OEM (original equipment manufacturer) and you said to them, we want to do something, there was panic in their faces because they had to go and change the hardware, and then there were multiple partners they had to talk to in order to do that.

Hiren Desai, Head of Strategy and Innovation North America for Continental, agrees that tier one suppliers will need to be able to create value by manufacturing intelligence rather than just parts.

Hiren says: “The supply chain is going to undergo disruption over the next 10 to 15 years significantly when it comes to software coming in and replacing all the hardware that companies are used to producing.

“Companies like Continental are experts in industrialisation, which essentially means manufacturing. Now, what we’re really talking about is having software factories able to produce intelligence, able to write code, able to produce artificial intelligence, that’s where it is heading.”

Whether it is in vehicles that transport people, goods or freight, OEMs will be looking for partners who can help them meet this demand. Traditional players will have to adapt and make room for new entrants from non-automotive backgrounds.

For Dr Engelbert Wimmer, CEO and founder of German specialist automotive management consultancy and investment company E&Co (Entrepreneurs and Consultants), this level of disruption can be seized upon by Irish companies.

“We are reconsidering every bit and piece of the traditional car,” he says. “That means changing materials and a whole new supply chain because the concept and characteristics of a vehicle that you want to operate 90,000km a year on a shared mobility or on an autonomous platform will be completely different because the durability and ownership will be changing.

“This means we will need to change the materials that vehicles are made from – from the rubber in the tyres to the steel and the chassis. We need to do a lot on recycling and greening the car by what components we will need. For companies who have interesting materials, who operate in material science and can supply components that are recyclable, this is a massive opportunity.

“You’re not just talking about tech companies, you’re looking at companies such as plastic moulders, or in the textile sector. It could be somebody from surface technology. It could be somebody in glass technology. Glass is a super interesting surface with a lot of functions, such as integrated light and displays. All these technologies are being reborn at the moment.

Many Irish companies enjoying success in the automotive sector are part of the Connected and Autonomous Vehicle (CAV) cluster, which is supported by Enterprise Ireland, IDA Ireland, Science Foundation Ireland, Department of Transport, and the Lero research centre.

With Jaguar Land Rover’s Centre for Networked and Autonomous Vehicles at Shannon and French vehicle technology giant Valeo’s facility in Tuam as members, CAV Ireland is fast establishing the West of Ireland as a hub for CASE vehicle development.

CAV companies collaborate to identify products and services which can capitalise on export opportunities in the automotive supply chain. It is an approach which Engelbert believes fits well with the future of mobility.

He says: “Whether it is software or materials, it is not about one company producing all this. It is about collaboration and partnership. The tool chain has many, many links that need to be linked together.”

Alpha Wireless is a market-leading specialist in high performing, superior quality antenna solutions covering macro to small cell antennas. The company exports to 22 countries worldwide and has opened its first research and development office in Australia. Enterprise Ireland supports include research and development projects, trade shows, market development programmes, and access to overseas networks.Overview:

By the time Fergal Lawlor discovered that the company he worked for was closing, he was already too invested to stop: “By then I had been a designer for two very innovative antenna companies that were disruptive in the market and were coming out with new products and challenging the incumbents that were there,” he says. “I had seen how that worked and I very much liked being part of that.”

Lawlor had spent several years designing wireless solutions with Argus Technologies in Australia, before returning to Ireland to work for an independent company, Sigma Wireless: “We were working on a number of innovative designs in the 3G space at the time,” he explains, “We had good products and we understood what the customer was doing.”

In 2005, US company PCTEL bought the Finglas-based business. “In 2007, they closed their Irish operations.”

For Lawlor, there was too much good work being left behind in Ireland: “I didn’t feel we were finished, so to speak. I knew the antenna designs, I knew a lot of the customers we were talking to, and I knew there was a skilled workforce in Ireland.”

Lawlor approached Enterprise Ireland, who helped him to conduct a feasibility study into the potential for continuing some of this work.

We came up with the conclusion that, yeah, there is a potential market there in this new emerging WiMAX for 4G. We went ahead and set up Alpha Wireless in 2007.”

Lawlor describes the gruelling process of expanding from a small office to a global business: “From day one we aimed at becoming a global player. Enterprise Ireland helped us through multiple rounds of funding, market development programmes, research and development projects, and trade shows. They also really helped us with contacts. This market is changing all the time. By focusing on new solutions, we have been able to break into overseas markets from our headquarters in Ballybrittas, Co. Laois – smack bang in the middle of Ireland.”

Lawlor’s previous designs had been tailored primarily for tier-one operators like Vodafone, and o2. “As a new company starting up, there was no chance we were going to be able to sell back into those tier one customers,” he explains, “so we picked a different market segment – WiMAX for 4G – where there wasn’t this existing relationship with vendors going back over the years. We were able to bring our expertise working with these tier ones to this market. It allowed us to go in and become the preferred antenna company for many radio vendors in this emerging market.”

Lawlor’s previous designs had been tailored primarily for tier-one operators like Vodafone, and o2. “As a new company starting up, there was no chance we were going to be able to sell back into those tier one customers,” he explains, “so we picked a different market segment – WiMAX for 4G – where there wasn’t this existing relationship with vendors going back over the years. We were able to bring our expertise working with these tier ones to this market. It allowed us to go in and become the preferred antenna company for many radio vendors in this emerging market.”

Alpha Wireless had soon won their first contract from Israeli company, Airspan Networks.

“A meeting with Airspan in Israel brought an opportunity to participate in a trial in Romania – giving just 12 hours’ notice. Martin Barrett quickly responded by booking a flight to Romania and hand-carried the AW3023 antenna for the forthcoming trial. All testing went very well, and the trial resulted in Alpha Wireless winning a contract for 1,500 antennas.” This is testament to Alpha Wireless’ agility and responsiveness providing fast and efficient solutions for their customers.

As the company grew, he brought in some of the designers and engineers who had worked together at Sigma: “We started our business by taking the good learnings to build something new,” he says. “The way we broke in was by finding new markets and knowing what kind of customers we wanted: we wanted customers who needed solutions that weren’t available off the shelf; where we could go in and work really closely with them to create a solution.”

As a young company, Alpha Wireless was one of Enterprise Ireland’s 15 new companies at their exhibition stand at the Pavilion in Dublin. “Sometimes it’s hard to quantify what you get out of these fairs, but you have to keep going to them. It helps to raise awareness and to scale up. We exhibited at a show in Chicago,” adds Lawlor, “which Enterprise Ireland also funds, and that’s how we got Samsung back in 2010”

Now, the company is at a level where they have their own booth at these fairs: “Today, the Mobile World Congress Barcelona is our most important show.”

“As you start getting access to bigger customers, you need local support,” says Lawlor, “and Enterprise Ireland helped us to understand local markets and set up offices in the US. They were able to connect us with operators and make the right introductions. Because of them, we have been able to do things that you normally have to wait much longer for.”

Only 12 years’ from its inception, Alpha Wireless has now become a market-leading specialist in high performing, superior quality antenna solutions covering macro to small cell antennas. The brand now exports to 22 countries worldwide and last year it opened its first research and development office in Australia.

Only 12 years’ from its inception, Alpha Wireless has now become a market-leading specialist in high performing, superior quality antenna solutions covering macro to small cell antennas. The brand now exports to 22 countries worldwide and last year it opened its first research and development office in Australia.

“It’s our ability to innovate that sets us apart,” explains Lawlor. “If the right antenna does not exist, we are committed to creating it.”

To find out more visit alphawireless.com.

“Enterprise Ireland is always extremely helpful in terms of providing meeting space and setting up partner meetings, finding out beforehand who we want to make contact with and enabling those briefings at the show.”

“Enterprise Ireland is always extremely helpful in terms of providing meeting space and setting up partner meetings, finding out beforehand who we want to make contact with and enabling those briefings at the show.”Overview:

In an always-on world where consumers expect instant access to information and experiences, car manufacturers are clamouring to ensure that 24/7 connectivity is provided behind the wheel — and Dublin-based Cubic Telecom is supplying the solution.

Cubic’s global connectivity platform PACE enables cars and other devices to automatically connect to high-speed local mobile networks around the world. The company is a fully licensed mobile services provider powering high-quality connectivity worldwide for global manufacturers, including six brands within Volkswagen Group, e.GO Electric Vehicles and Panasonic Automotive, among others.

Not to mention, Cubic’s connected car solution supports 2.5 million cars in 93 markets globally, with capabilities across Europe, North America, Latin America, the Middle East, Russia, Africa and Asia-Pacific.

“Our focus spans wider than the Irish market,” reveals CCO Gerry McQuaid, who has been part of the Cubic Telecom team from its beginning in 2009. “Obviously we support the sale of our partners’ products in Ireland but we are focused on the global market and we have had that global focus from the start.”

But scaling internationally requires more than identifying a global customer base and Gerry says Enterprise Ireland’s assistance has been critical in helping Cubic to forge strategic partnerships every step of the way.

When Cubic Telecom made its first foray into the international market, it was with a SIM card that let travellers make low-cost phone calls from anywhere in the world without incurring huge roaming charges. But the company soon switched gears to focus on creating technology that would connect any device to the internet while abroad and in 2012 took part in a major trade mission to China, helmed by Enterprise Ireland and then Taoiseach Enda Kenny.

“Enterprise Ireland helped to arrange private meetings in China with the Taoiseach which gave a fantastic boost to our fledging profile in China,” Gerry says, noting that the trip ultimately helped to cement our business relationships with Qualcomm, Lenovo and China Unicom.

At the same time, demand for vehicle connectivity was on the rise. Automakers wanted to transform cars into infotainment centres on wheels and Cubic Telecom’s technology, which is embedded at the manufacturing stage, could enable standardised vehicles to offer connected services anywhere in the world.

“We’ve always attended MWC and exhibited as part of Enterprise Ireland’s pavilion stand. That’s where we meet our customers, prospects, mobile operator partners, technology partners and important industry analysts every year,” Gerry says. “We are delighted with the support provided to us by Enterprise Ireland in regard to exhibition stand facilities and the arrangement of key meetings ahead of each event.”

Cubic’s first auto contract was with German car giant Audi, which was looking to provide its drivers with a fully digital experience — something that traditional mobile operators were struggling to achieve.

“We were delighted to partner with the leading automotive brand within Volkswagen Group and this partnership has been an intrinsic part of developing our business success in Germany,” Gerry says.

As a result, Germany is one of Cubic’s biggest overseas markets.

“It’s important to point out that we did not select Germany as a generic target market,” Gerry says. “Instead, we looked at the world’s biggest automotive manufacturers and decided which companies we wished to build a partnership with. This naturally led us to Germany, the home of some of the world’s top auto manufacturers. We were very careful to take the time to understand what is required to do business successfully with large prestigious German companies and we had excellent support from the Enterprise Ireland team in Germany.”

Enterprise Ireland still works closely with Cubic Telecom to support its continued growth in other international markets.

“As well as being part of Enterprise Ireland’s pavilion at MWC Barcelona annually, last year we participated with Enterprise Ireland in MWC Americas in Los Angeles for the first time. That proved to be a great success,” shares Elaine Murray, Cubic Telecom’s External Communications Manager, adding, “Enterprise Ireland is always extremely helpful in terms of providing meeting space and setting up partner meetings, finding out beforehand who we want to make contact with and enabling those briefings at the show.”

Besides trade shows and networking opportunities, Cubic Telecom is often invited to sit on conference panels hosted by Enterprise Ireland, which Elaine describes as “integral” to the company’s exposure in foreign markets. Gerry agrees: “We’re always more than happy to participate because it’s a win-win situation.”

One of the next stops on Cubic’s path to world domination is Brazil, a notoriously tough nut for non-Brazilian car manufacturers to crack in terms of IoT connected device services.

“We have received excellent advice from Enterprise Ireland to assist with setting up our local presence in Brazil,” Gerry says. “Like in Germany, we align ourselves with the markets that our customers have prioritised. As all of the world’s major automotive companies want to sell connected cars in Brazil, we prioritised establishing a unique locally compliant solution for global automotive and IoT companies there.”

Speaking of complicated, while the UK is not a dominant market for Cubic, it is an important one for many of the company’s customers.

“If you’re driving on the motorways in the UK, most of the cars are German-built cars, so Brexit does have a concern for us in terms of what’s going to happen to the ease of doing business but we’re not as exposed as other companies because we are used to dealing with complicated market conditions around the world,” Gerry says.

His advice: Irish companies must reduce their dependence on the UK market, regardless of the Brexit outcome.

“Start by considering the needs of the customer you are selling to, what solution you are selling, who you need to sell it to and what markets those target customers are in. Then leverage the Enterprise Ireland regional offices to get introductions to the people in that market who you need to meet.”

Read more on the supports available to help your business diversify into new markets or speak to your Development Advisor today.

Overview:

The European Union has identified smart farming as a key component in supporting sustainable agriculture and food production, protecting natural resources and boosting food safety. At the heart of this is the need for new technology and standards to achieve full supply chain interoperability.

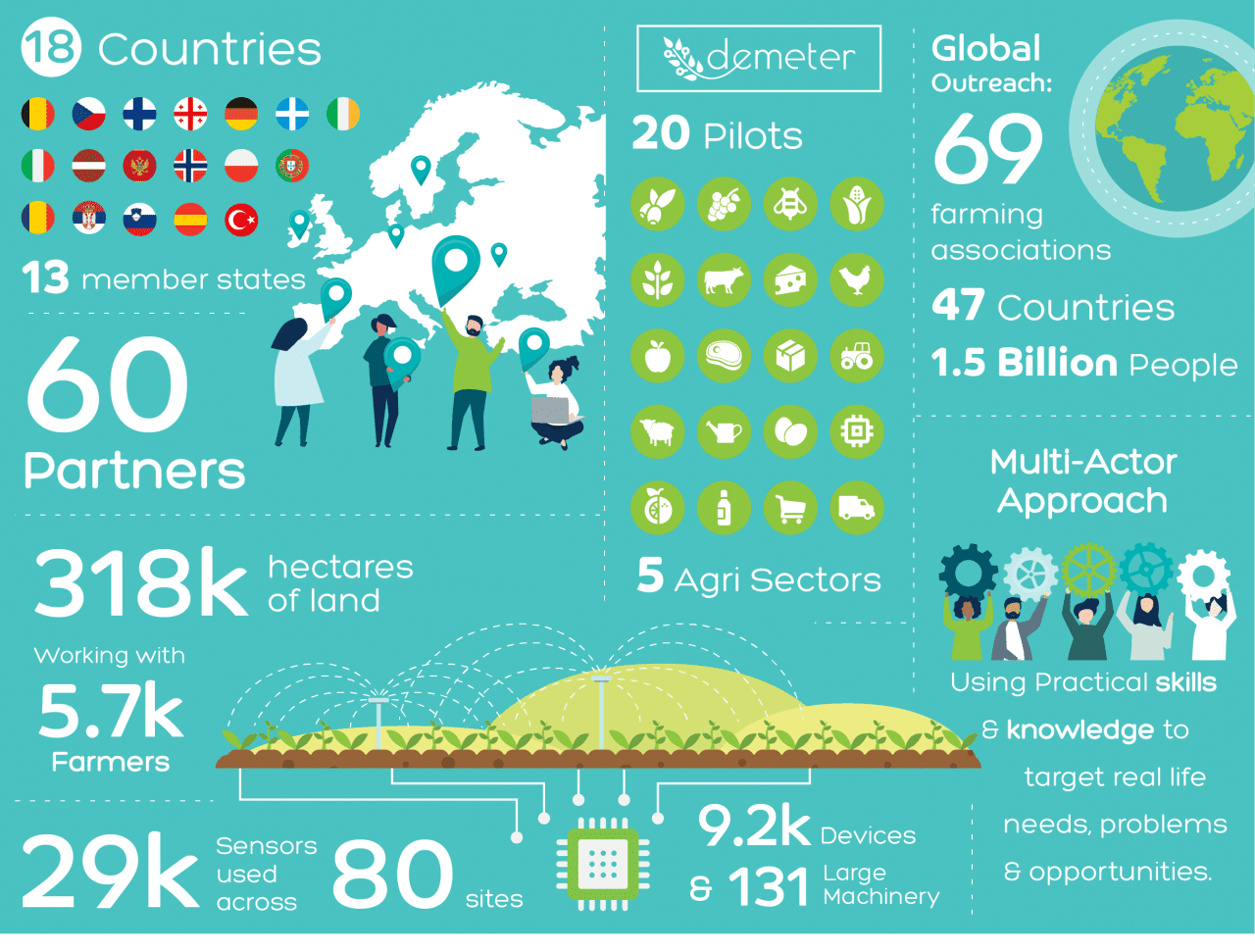

This is the subject of DEMETER, a large-scale, €17.7m Horizon 2020 project involving 60 partners across 18 countries, 6,000 farmers and 38,000 devices.

At the helm of DEMETER is Kevin Doolin, Director of Innovation at Telecommunications Software & Systems Group (TSSG), an internationally recognised centre of excellence for ICT research and innovation and part of the Waterford Institute of Technology.

“The situation now is that you have various different elements in the agri supply chain – machinery, warehouses, trucks, sensors and so on – but none of these systems talk to each other so it’s impossible to get a holistic view from farm to fork,” explains Doolin.

“With DEMETER we’re trying to connect those elements, so we’re developing new industry standards, writing software for platforms and building interfaces.”

DEMETER’s goal is nothing less than the digital transformation of Europe’s agri-food sector and it includes a series of 20 pilot programmes that aim to demonstrate the impact of the technology.

A key deliverable is the DEMETER Dashboard. “This will give farmers an instant update on the status of their farm. It’s a precision support system that provides information to assist decision making, and increase productivity and efficiency,” says Doolin.

The first step in the Horizon 2020 process is building the consortium, which Doolin did using his extensive network of contacts and the opportunities afforded by networking events run by the Commission.

“It’s important to identify a core set of partners that you can rely on to help write the proposal. Within DEMETER there are about 10 partners that did most of the heavy lifting on that, and then we drew on expertise from the other partners when required.

“We also engaged quite heavily with Enterprise Ireland’s National Contact Points who were able to introduce us to additional partners. And the EI financial support we got to write the proposal was really important.”

As a highly experienced Horizon 2020 co-ordinator, Doolin was aware of the challenges a project of this size, one of the largest ever coordinated by an Irish entity, presents.

“There were multiple challenges, including a substantial amount of EU politics at the start with many partners wanting to take the lead, but we were determined to keep DEMETER rooted in Ireland,” says Doolin.

Co-ordinating 60 partners is an ongoing challenge but one that is mitigated, says Doolin, by having good work package leaders.

“Each Horizon 2020 project is structured into a number of work packages with specific roles. If you have a good team of work package leaders you can leverage them very heavily to co-ordinate the overall effort.”

Moreover, the challenges are offset by the benefits.

“Horizon 2020 enables us to engage in large-scale work, with a substantial group of partners from across the agri supply chain. We have access to technology providers, research and academic experts, real works users and policy makers,” says Doolin.

Involvement in a Horizon 2020 project can be as a partner organisation or as co-ordinator. Doolin strongly recommends starting as a partner.

“I estimate the level of work involved in being a participant versus co-ordinating to be about 1:10, so I think the best place for institutions to start is by partnering on a proposal and maybe taking a work package leader role where you’re involved in writing the proposal. After you’ve done a few projects you can go down the route of co-ordination, starting with a small project.”

Doolin also advises engaging early with Enterprise Ireland to find out the project topics that are coming up in the next Horizon round of funding, and starting to build the consortium before the Commission launches the call for proposals.

“After the call you’ve only three months to write the proposal, which isn’t a lot of time,” he says.

“It’s also important to tell Enterprise Ireland what proposals you’re writing or you can end up in a situation where different entities in Ireland are writing competing proposals when in fact we should be collaborating. Enterprise Ireland is the mechanism for bridging that gap.”

Within the DEMETER project €1m of funding has been reserved to be given out to new partners who want to join the programme.

“We’ll be issuing our own mini-calls for proposals starting on September 16, inviting SMEs and farmers and so on to come up with a small project idea that will test elements of DEMETER in different scenarios.

“These open call projects are something that I think industry in Ireland needs to take advantage of. It’s a really good way for companies to get into Horizon 2020 and get quite a bit of funding to do just one trial of the technology.”